Recognizing the Process and Benefits of Offshore Company Development

Discovering the realm of offshore organization formation provides interesting strategic benefits for business owners, including potential tax advantages, privacy, and accessibility to international markets. This complex equilibrium of benefits and challenges welcomes further exploration right into the subtleties of developing an offshore company.

Selecting the Right Jurisdiction for Your Offshore Company

When choosing a jurisdiction for an overseas firm, it is critical to think about legal, fiscal, and functional aspects. Each territory offers unique benefits and difficulties, which can considerably influence the success and performance of an offshore entity. Fiscal factors to consider frequently control the decision-making process, as prospective tax obligation benefits are a primary motivator for overseas consolidation. Various territories give differing levels of tax incentives, from minimized prices to total tax exemptions.

Functional aspects likewise play a critical duty. These consist of the ease of firm arrangement, the schedule of expert services, and the total service atmosphere. Some territories boast sophisticated economic services industries with a wealth of knowledge in supporting offshore firms (Offshore Business Formation). Others might use more personal privacy yet less support infrastructure. Entrepreneurs must stabilize these facets to choose one of the most suitable location for their business demands, ensuring that the jurisdiction lines up with their lasting goals and strategic goals.

Lawful and Regulative Considerations in Offshore Unification

Recognizing these subtleties is crucial to prevent lawful challenges and penalties. Organizations should also continue to be knowledgeable about global policies, such as the Foreign Account Tax Obligation Conformity Act (FATCA) in the United States, which impacts how overseas economic accounts and entities report to the internal revenue service.

Strategic Advantages of Developing an Offshore Business

In addition, accessing worldwide markets ends up being more feasible through an offshore entity. This strategic positioning can facilitate easier entrance right into international markets, promoting wider service reach and prospective consumer base expansion. Offshore entities also gain from potentially more favorable company regulations that could supply much less administration and higher adaptability in company governance and operations.

Furthermore, diversification through offshore procedures can reduce risk by spreading possessions across various areas, thereby shielding the company from regional financial instabilities or market changes. These critical benefits emphasize why many companies seek overseas possibilities.

Usual Difficulties and Solutions in Offshore Business Formation

While offshore organization formation presents numerous calculated advantages, it also introduces a range of obstacles that call for careful administration. Offshore companies should comprehend their tax commitments in multiple territories get more to enhance and avoid legal effects tax efficiencies.

An additional considerable difficulty is the capacity for reputational threats. The understanding of overseas activities can sometimes be negative, suggesting tax obligation evasion or unethical actions, also when operations are legal and transparent. To respond to these obstacles, services should invest in skilled lawful advise knowledgeable about worldwide and local regulations. Engaging with trusted regional companions and consultants can likewise offer invaluable insights and aid in keeping go to these guys compliance. Transparent procedures and clear communication are necessary to protecting credibility and making sure long-term success.

Verdict

Finally, developing an offshore company deals substantial critical benefits including tax benefits, personal privacy, and access to global markets. Picking the ideal territory and browsing the intricate legal landscape require cautious consideration and frequently expert advice. While difficulties such as governing scrutiny and reputational threats exist, with the ideal approach and compliance, the advantages of offshore unification can significantly surpass these obstacles, sustaining service growth and international diversification.

Exploring the world of offshore service formation uses appealing calculated benefits for entrepreneurs, consisting of potential tax obligation benefits, personal special info privacy, and access to worldwide markets.While overseas company formation provides several tactical benefits, it additionally presents a variety of difficulties that need cautious administration. Offshore organizations have to comprehend their tax obligation commitments in numerous jurisdictions to enhance and prevent lawful repercussions tax efficiencies.

In final thought, creating an overseas company deals considerable critical benefits consisting of tax benefits, privacy, and accessibility to worldwide markets - Offshore Business Formation. While challenges such as regulative analysis and reputational risks exist, with the right method and conformity, the benefits of overseas incorporation can considerably outweigh these obstacles, supporting company growth and worldwide diversification

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Heath Ledger Then & Now!

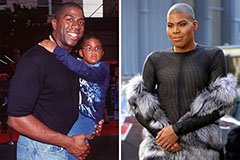

Heath Ledger Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!